OUR FATHER'S LUTHERAN CHURCH FOUNDATION MISSION STATEMENT

Prayerfully receiving, investing and distributing the gifts of our community to support the mission of Our Father's Lutheran Church to build the community of Christ through Relationships, Service, Teaching and Hospitality.

Please keep the Foundation at OFLC in mind for your charitable giving.

The Foundation receives and invests financial gifts. Then, with the interest gained from those donations, the Foundation distributes those gifts back to the community.

Donations can be given in a variety ways!

The Foundation receives and invests financial gifts. Then, with the interest gained from those donations, the Foundation distributes those gifts back to the community.

Donations can be given in a variety ways!

WAYS TO GIVE

|

GIVEMN:

Donations can be easily given year round online by using the GIVEMN donation field here on our website! GIVEMN allows you to make a one-time or recurring donation through a secure site/connection in the amounts listed or by entering a custom amount. Simply complete the fields on this page or navigate to the GIVEMN site by clicking the blue donate button above. *Note- All online gifts processed through GIVEMN and Simply Giving incur a service charge related to credit card and platform fees. We accept these charges in an effort to make it as easy as possible for individuals to donate. If you are interested in offsetting those costs- you can choose to pay the service fees on top of your donation. If you are interested in avoiding these fees altogether, please reach out to the church regarding alternative payment options, including those listed further below. |

|

Simply Giving:

Donations can be given easily online by using the Simply Giving Button below! Simply Giving is a program that allows you to make a one-time or recurring donation through a secure site. Donations are accepted via credit/debit cards. Recurring giving schedules may be set up on a weekly, semi-monthly, or monthly basis. Simply Giving can be done on your smart phone or computer. This allows you the option to give anywhere or anytime! Once you click the link, simply scroll down to OFLC Foundation!

*Note- All online gifts processed through GIVEMN and Simply Giving incur a service charge related to credit card and platform fees. We accept these charges in an effort to make it as easy as possible for individuals to donate. If you are interested in offsetting those costs- you can choose to pay the service fees on top of your donation. If you are interested in avoiding those fees, please reach out to the church regarding alternative payment options.

Donations can be given easily online by using the Simply Giving Button below! Simply Giving is a program that allows you to make a one-time or recurring donation through a secure site. Donations are accepted via credit/debit cards. Recurring giving schedules may be set up on a weekly, semi-monthly, or monthly basis. Simply Giving can be done on your smart phone or computer. This allows you the option to give anywhere or anytime! Once you click the link, simply scroll down to OFLC Foundation!

*Note- All online gifts processed through GIVEMN and Simply Giving incur a service charge related to credit card and platform fees. We accept these charges in an effort to make it as easy as possible for individuals to donate. If you are interested in offsetting those costs- you can choose to pay the service fees on top of your donation. If you are interested in avoiding those fees, please reach out to the church regarding alternative payment options.

Stock* Gifts:

Making a stock or real estate gift is an efficient way to meet your charitable giving goals, and maximize tax savings. The appreciation in the stock or real estate is not taxed and you still get a charitable deduction for the full fair market value of the stock or real estate.

*Note- Gifts of stocks/bonds are typically transferred without information that identifies the donor. If you wish for your gift to be acknowledged, please notify the Foundation of gifts of stocks/bonds to ensure that your generous gift is properly identified and receipted for tax purposes.

Making a stock or real estate gift is an efficient way to meet your charitable giving goals, and maximize tax savings. The appreciation in the stock or real estate is not taxed and you still get a charitable deduction for the full fair market value of the stock or real estate.

*Note- Gifts of stocks/bonds are typically transferred without information that identifies the donor. If you wish for your gift to be acknowledged, please notify the Foundation of gifts of stocks/bonds to ensure that your generous gift is properly identified and receipted for tax purposes.

Tribute Gifts:

A gift to OFLC Foundation in memory or in honor of a friend or loved one is a wonderful way to memorialize a special person in your life while helping sustain our work in the community.

A gift to OFLC Foundation in memory or in honor of a friend or loved one is a wonderful way to memorialize a special person in your life while helping sustain our work in the community.

Legacy Giving:

Supporters can choose to leave a gift in their will or trust as an important way to have long-term impact, without any upfront cost during their lifetime.

Supporters can choose to leave a gift in their will or trust as an important way to have long-term impact, without any upfront cost during their lifetime.

Qualified Charitable Distributions (QDC):

Qualified Charitable Distribution (QCD) allows certain IRA holders, who are 72 or older, the opportunity to withdraw $100 to $100,000 annually from their Traditional or Roth IRA and deliver the funds directly to a qualifying charitable organization, this may result in a tax-free distribution (RMD). Check with a tax professional regarding the specifics of your charitable donation.

Qualified Charitable Distribution (QCD) allows certain IRA holders, who are 72 or older, the opportunity to withdraw $100 to $100,000 annually from their Traditional or Roth IRA and deliver the funds directly to a qualifying charitable organization, this may result in a tax-free distribution (RMD). Check with a tax professional regarding the specifics of your charitable donation.

Workplace Giving:

Many companies have different opportunities for their employees to make donations to organizations they care about through a workplace giving program. These programs are set up in varying ways some during specific times of the year while others are open all year. Consult with your HR office to find out if your employer has a matching gift program and what steps are necessary to enroll.

Many companies have different opportunities for their employees to make donations to organizations they care about through a workplace giving program. These programs are set up in varying ways some during specific times of the year while others are open all year. Consult with your HR office to find out if your employer has a matching gift program and what steps are necessary to enroll.

MISSION IN ACTION

Rockford Fire Department Toy Drive Donation

Montrose FE-ED Program

|

FE-ED is a free food distribution program serving the greater Montrose area. Funds distributed to FE-ED will support the purchase of storage trailers - making it easier to move supplies from site to site, relieve the burden on volunteers, and better serve our community members in need of food resources.

Currently, over 100 families are provided with free produce, dairy, and protein each month through this program! |

Pictured: Becky Miller - OFLC Board President and Kimberly Niska - Executive Director for Grace Place Collaborative

|

RiverWorks Lunch Box Express, Matching Funds Donation

|

Pictured: Becky Miller (Foundation President) and Denise Kesanen holding a large check from the OFLC Foundation to RiverWorks - Lunch Box Express for $3,000.

|

Lunch Box Express serves one of the greatest needs of our community- nourishing the minds and bodies of our children.

Through the funds the OFLC Foundation contributed to the RiverWorks Lunch Box Express program, we are helping to achieve three goals: 1. Feed children 2. Provide fulfilling volunteer opportunities 3. Live Jesus' call to feed the hungry and serve our community Providing a matching funds donation is a unique way to engage the broader community in this giving campaign- leveraging the charitable gifts provided to and grown through investments by OFLC foundation. |

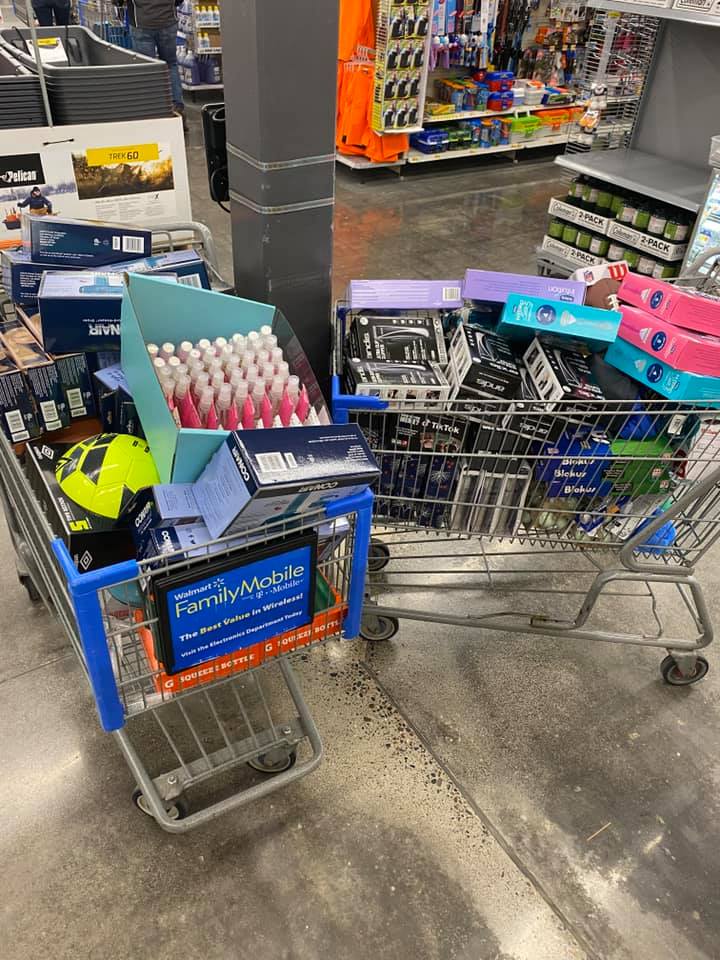

Rockford Fire Department Toy Drive Donation

Our Father's Lutheran Foundation is proud to support our community and the Rockford Fire Auxiliary's annual toy drive by donating $500 to their 2022 Christmas Present Program.

OFLC 50th Anniversary Picnic Sponsor

Donation to RiverWorks/Mason Match

"Thank you and the Foundation for this generous gift." -Denise Kesanen

Pictured: Eric, Tammi, Becky, and Mark holding a large check from the foundation to the Star Lodge 62 RiverWorks Fundraiser for $2,000 signed by Becky Miller, Foundation President.

Grace Place - Freezer/Shelving Donation

"Thank you OFLC Foundation for supporting Grace Place's food ministry! Your generous donation provided much-needed storage for our food donations to aid in weekly distributions! Thanks to donors like you we are reducing the hunger of bodies, minds, and souls in our community and beyond."

For I was hungry and you gave me something to eat, I was thirsty and you gave me something to drink, I was a stranger and you invited me in. -Matthew 25:35

Pictured: Grace Place volunteers standing near their freezer and holding up shelving.

Rockford Fire Department Toy Drive Donation

|

Pastor Aaron Fuller and OFLC Foundation Director Mark Nelson delivered a $500.00 check to the Rockford Fire Department Auxiliary on behalf of the OFLC Foundation.

The money was used for the Christmas Present Program for the Rockford community. Pictured: Rockford Fire Auxiliary Facebook post thanking OFLC Foundation for the donation. |

OFLC Trunk of Treat Sponsor

Pictured: Various photos from the Trunk or Treat event.

Fire Santa Project Donation

Thank you to our generous donors for making these gifts and events possible!